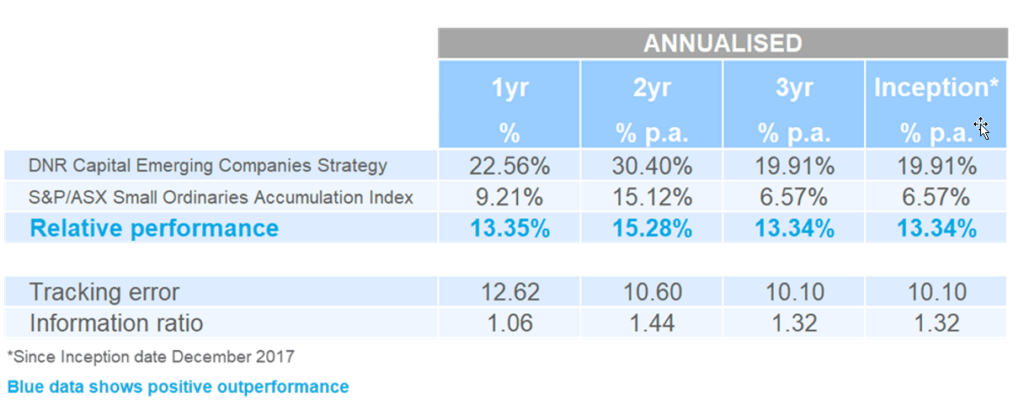

The DNR Capital Australian Emerging Companies strategy has reported returns of 19.91% p.a.1 since its inception in December 2017, outperforming the S&P/ASX Small Ordinaries Accumulation Index by 13.34%p.a.1

Recently marking its three-year anniversary, the strategy offers investors a concentrated exposure to high quality listed Australian small companies.

The managed fund2 for the strategy was launched by Australian equities specialist DNR Capital in the second half of 2018 to meet a demand by Australian investors to access high quality long-term opportunities in the local emerging companies sector. The fund’s investible universe is the ASX Small Companies Index and is focused on building a concentrated portfolio investing for the medium to long-term.

Sam Twidale, Portfolio Manager for the strategy and fund, noted: “The strategy provides investors with access to DNR Capital’s highly regarded bottom up stock selection approach to build a portfolio of quality small cap companies trading at attractive valuations.”

Mr Twidale said: “The Australian small cap sector is a particularly inefficient part of the market, providing significant opportunities to add value from applying a consistent and proven investment process. We believe our quality discipline is proving to be even more relevant to this part of the market.”

“Now is the time for investors to prepare for the COVID-19 recovery,” Mr Twidale noted.

“We believe there is the potential for a strong economic recovery in 2022-23 as the economic and health crisis normalises. Policy remains highly supportive with low interest rates and significant fiscal stimulus. This is likely to be sustained until the economy strengthens and inflationary pressures build. Australian households are well positioned given high savings rates and ongoing policy support.

“We believe the rotation is likely to continue given the high valuation dispersion across the market, creating a fertile hunting ground for bottom-up stock picking. Out of growth/defensives companies with high valuations, into value/cyclicals stocks with low valuations and greater sensitivity to an improving economy.”

He said: “Given the magnitude of the virus’s impact, we have been considering the long-term investment implications for the DNR Capital Australian Emerging Companies strategy and Fund as it could well mark an interesting turning point in history.

“We see attractive opportunities in companies negatively impacted by COVID-19 in the short-term, but where the long-term outlook remains positive. The market has been overly focused on the challenging environment in the short-term, allowing us to take advantage of our long-term time horizon.

“Our focus has been on some of the worst hit sectors like travel, consumer cyclicals and education. In this area, significant pent-up demand could lead to a sharp earnings recovery. We also see a number of opportunities in the resources sector, particularly commodities exposed to increasing renewables investment and the transition to electric vehicles”

“We also remain positive on industry leading companies which haven’t wasted this crisis, by either undertaking bottom of the cycle acquisitions or investing through the downturn. This will allow them to emerge from the downturn in an even stronger competitive position. Some of these leaders include IDP Education, IGO, Corporate Travel Management and Lovisa Holdings”.

Robert White, DNR Capital Chief Executive Officer highlighted the investment team’s strong commitment to the investment process that increased the quality of the strategy and the Fund.

“The year-on-year performance for the Australian Emerging Companies strategy has been extremely strong and with our experienced team and proven philosophy and process, the outlook is very positive”, said Mr White.

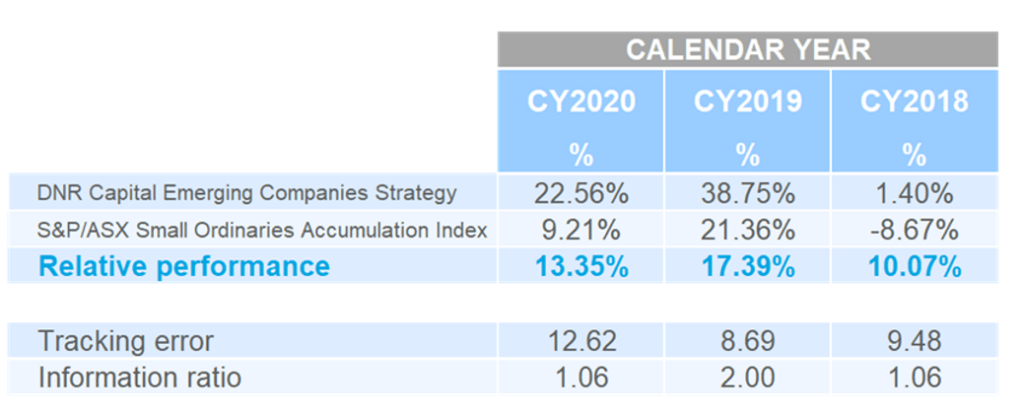

DNR Capital Australian Emerging Companies strategy – Gross performance – 31 December 2020

Past performance is not an indication of future performance.

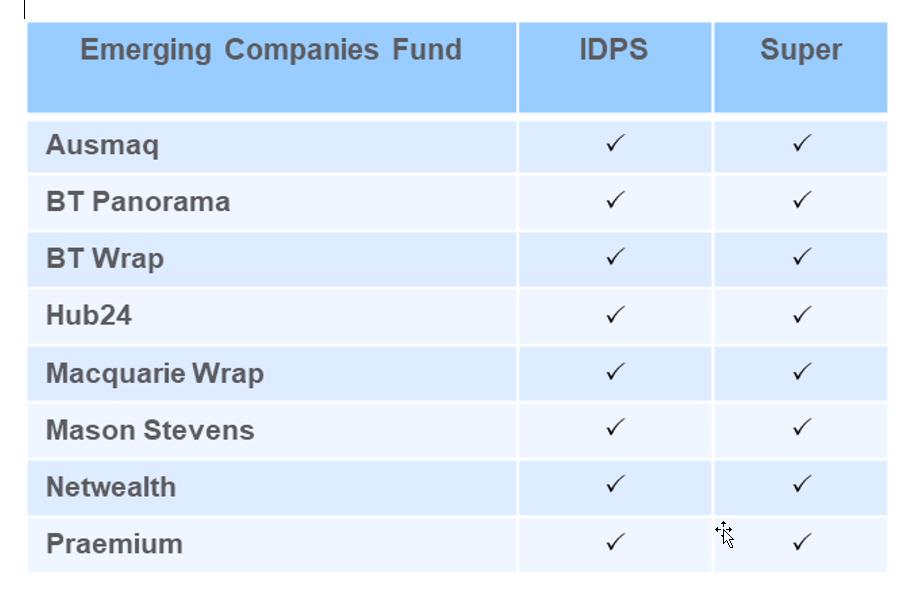

The DNR Capital Australian Emerging Companies Fund is available to direct individual investors and to financial advisers via leading investment and super administration platforms including:

For more information please visit the DNR Capital Australian Emerging Companies Fund.

______________________

1 Gross of fees and taxes.

2 DNR Capital Australian Emerging Companies Fund, ARSN 627 783 957.

IMPORTANT NOTE: The information relating to DNR Capital has been prepared by DNR Capital Pty Ltd, AFS Representative – 294844 of DNR AFSL Pty Ltd ABN 39 118 946 400, AFSL 301658. Whilst DNR Capital has used its best endeavours to ensure the information within this document is accurate it cannot be relied upon in any way and you must make your own enquiries concerning the accuracy of the information within. The information in this document has been prepared for general purposes and does not take into account your particular investment objectives, financial situation or needs, nor does it constitute investment advice. Before making any financial investment decisions you should obtain legal and taxation advice appropriate to your particular needs. DNR Capital will not be responsible or liable to anyone who acts or relies upon anything contained in, or omitted from, this document. Past performance is not indicative of future performance.