Labor’s recently announced franking policy relating to cash refunds highlights the importance of capital preservation & diversification for retirees, according to DNR Capital’s portfolio manager for its Australian Equities Income Portfolio, Scott Kelly.

Franking credits are designed to reduce or eliminate double taxation of dividends. They are a tax refund for shareholders of companies where tax has already been paid. Currently, if you pay less tax, then you can claim a refund.

“We will not get into the relative merits of Labor’s policy. However simplistically it would appear that Labor’s policy penalises people for owning shares relative to other potential investments.

“We believe this highlights that income seeking investors need to look beyond any single asset class and should specifically consider further diversification within Australian equities with strategies focussed on tax-advantaged, reliable and growing income generation – which goes beyond the usual suspects”, says Kelly.

“Traditionally, investors looking for yield in Australian equities have concentrated their exposure to the big banks and Telstra, which contribute around 40% of the ASX200 dividends paid.

Whilst investors may have received a reasonable income, and franking benefits, from these investments over the last 10 years, capital has been eroded’’, added Kelly.

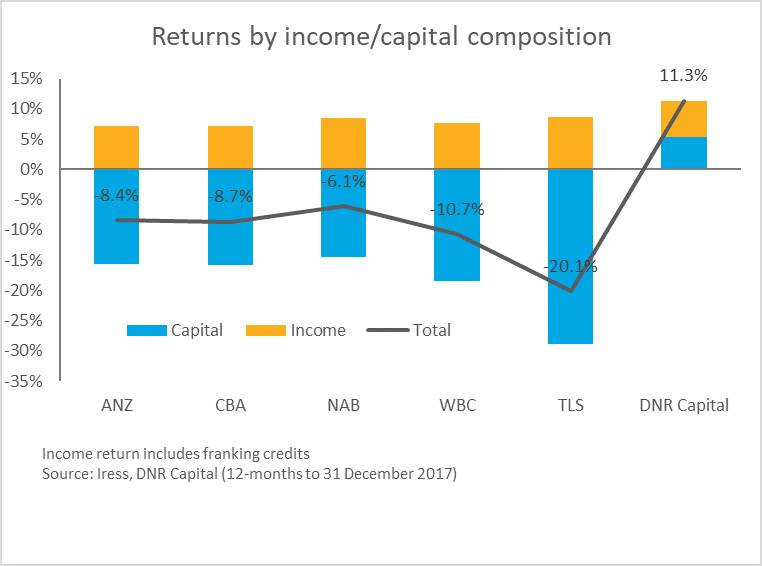

“The following chart highlights how the big 4 banks and Telstra have performed over the 2017 calendar year, all delivering investors negative total returns.

This compares to the DNR Capital Australian Equities Income Portfolio which delivered a total return of +11%, including +5.9%income (including franking).

Whilst the Labor policy diminishes the value of franking for some investors, it still acts as a mechanism for reducing the double taxation of dividends for anyone with a taxable income”, says Kelly.

“In addition, companies with large franking credit balances may embark on a capital management strategy, should Labor prevail at the next election.

“Before investors flock toward higher risk asset classes that, in our opinion, have stretched valuations, for example, unlisted and listed property, infrastructure and utilities, they could consider the alternatives for generating income.

“We believe local companies that fit this bill include Woolworths, Suncorp, Brambles, and IPH Limited and are holding them in our portfolio in preference to bond proxies and the banks.

About DNR Capital

Founded in 2001, DNR Capital is an Australian investment management company that delivers client-focused, quality, investment solutions to institutions, advisers and individual investors. DNR Capital is a signatory to the Principles for Responsible Investment (PRI).

DNR Capital’s leadership in the Separately Managed Account (SMA) sector was reaffirmed by being named SMA of the year at the Money Management Fund of the Year Awards 2017 for its Australian Equities High Conviction SMA.

For more information, please contact:

IMPORTANT NOTE: The information relating to DNR Capital has been prepared by DNR Capital Pty Ltd, AFS Representative – 294844 of DNR AFSL Pty Ltd ABN 39 118 946 400, AFSL 301658. Whilst DNR Capital has used its best endeavours to ensure the information within this document is accurate it cannot be relied upon in any way and you must make your own enquiries concerning the accuracy of the information within. The information in this document has been prepared for general purposes and does not take into account your particular investment objectives, financial situation or needs, nor does it constitute investment advice. Before making any financial investment decisions you should obtain legal and taxation advice appropriate to your particular needs. DNR Capital will not be responsible or liable to anyone who acts or relies upon anything contained in, or omitted from, this document. Past performance is not indicative of future performance.