A decade after the global financial crisis

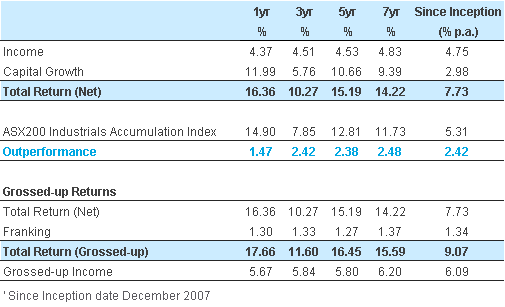

The inception of the DNR Capital Australian Equities Income Portfolio (Income Portfolio) in December 2007 also marked the beginnings of the global financial crisis. Since then, the primary goal of retirees, to fund living expenses whilst preserving capital, has become increasingly difficult to achieve. However, the Income Portfolio has delivered a total return of ~9.1% pa over this period, including franked income of ~6.1% pa.

Portfolio Manager, Scott Kelly, believes income seeking investors need to look beyond any single asset class and specifically consider a higher allocation to Australian equities with strategies focused on tax-advantaged, reliable and growing income generation.

The problem facing retirees

In the 10 years that have followed the financial crisis, aging demographics, increased life expectancies, low returns and the increased frequency of tail risks (or shocks) are all acting as headwinds for retiree goals and increasing the likelihood that they may outlive their savings. Low inflation, low interest rates, a scarcity of growth and general conservatism have all led investors to pay a premium for ‘yield’ over the last decade. However, traditional ‘income’ asset classes (i.e. cash, fixed deposits, bonds, property) are currently trading at or near historic low yields and in turn, high valuations. In 2007, fixed income rates were greater than 6%, they are now ~2%. Whilst these assets are typically seen as reliable options for protecting capital, capital may now be eroded over time by inflation (or rising yields).

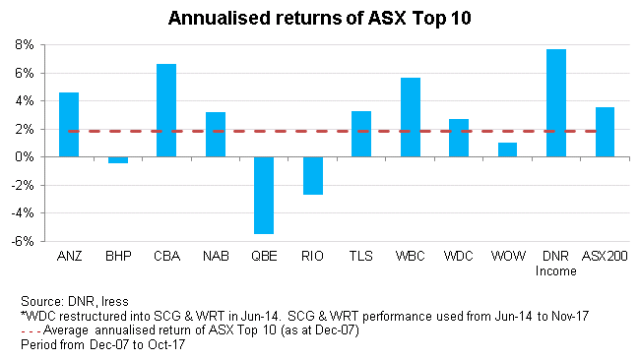

Traditionally, investors looking for yield in Australian equities have concentrated their exposure to the top 10 companies which contribute more than 50% of the ASX200 dividends paid. Whilst investors may have received a reasonable income from these investments over the last 10 years, dividends have been cut and in the majority of cases, capital has been eroded. The following chart highlights that a basket of the top 10 companies would have significantly underperformed the market in the period since the financial crisis.

Defensives (primarily Healthcare) and bond proxy exposures (that is, REITs, Infrastructure and Utilities) have been the main beneficiaries over this period. However, these stocks are now trading at inflated valuations and are vulnerable to changing global conditions, in our view. Inflationary pressures, government fiscal stimulus and populist policies are likely to lead to higher interest rates and place pressure on these stocks. During the bond correction of November 2016, we saw how quickly the market can adjust the way it is prepared to value these stocks.

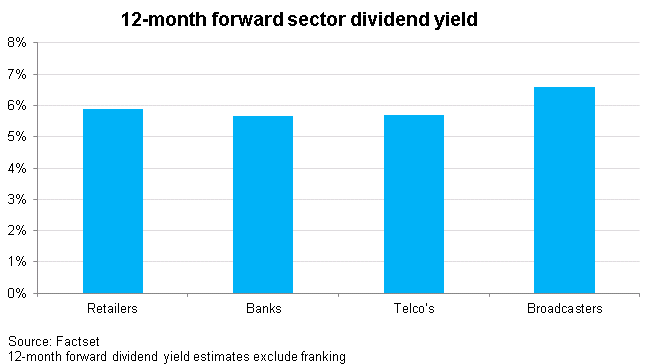

Income investors can be attracted to high yielding companies on the stock market. However a high yielding company can often indicate the potential for a dividend cut if it is not sustainable. As the following chart highlights, the current yields on offer in the Media, Retail, Telecommunications and Bank sectors appear attractive, however they are all facing significant structural challenges and both dividends and capital may be at risk.

- Media / Broadcasters stocks are facing substantial competition from Facebook, Twitter and Netflix;

- Retailers await the entry of Amazon;

- Telecommunications face heightened competition in a post-NBN world and other technological advances; and

- Banks are facing an over-leveraged consumer, property headwinds, cyclically low bad debts, regulatory / political risks, as well as technological threats.

To add further complexity, post the financial crisis, Australian companies have been under pressure to maintain high dividends at the expense of future reinvestment. As such, there are companies that have been under-investing on capital expenditure, have stretched balance sheets or are paying dividends in excess of free cash flow. Elevated payout ratios at a time when the earnings outlook is not particularly strong increases the potential for declining payout ratios and/or dividend cuts.

The solution for retirees

Income seeking investors need to look beyond any single asset class and specifically consider a higher allocation to Australian equities with strategies focused on tax-advantaged, reliable and growing income generation. Investors may not be aware that the volatility in the dividends of Australian equities is actually lower than traditional income asset classes (i.e. fixed deposits, bonds etc.) over the long-term, providing retirees with greater visibility on future income.

The Income Portfolio is designed for investors seeking exposure to a tax-advantaged, reliable and growing income stream and provides investors with exposure to active management and high conviction ideas. The Income Portfolio was incepted in December 2007 and has delivered an average total return of ~9.1% pa over this period, more than 2% above its benchmark on a consistent basis and delivered investors an average income of ~6.1%, including franking. It is benchmarked against the ASX 200 Industrials Accumulation Index, which produces higher levels of income than the ASX200 Accumulation Index, with less volatility.

Despite our under-weight positions in the big 4 banks and Telstra, the 12-month forward yield of the Income Portfolio is currently ~6.3%, including franking.

DNR Capital Australian Equities Income Portfolio Performance

Our process

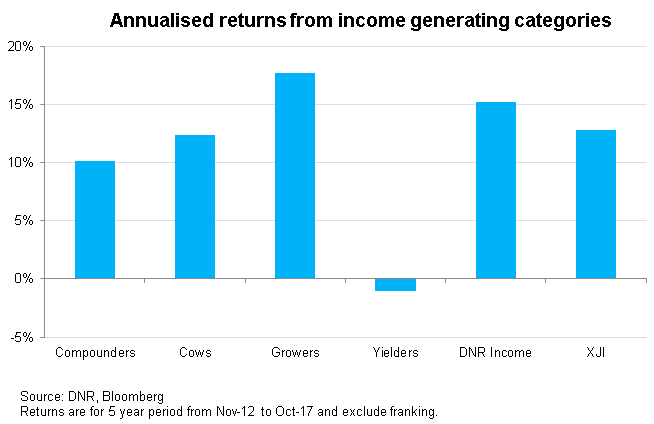

Assessing a company’s dividend sustainability is core to the DNR Capital Australian Equities Income Portfolio process. We are primarily looking for quality companies that can demonstrate the ability to sustain and grow dividends over time. We want to have reasonable certainty of a company’s underlying cash generation and the dividend profile over the next 3-5 years. At DNR Capital, we categorise income generating companies as:

Growers: A company that is delivering below market income, however delivers above market income growth. For example, Macquarie Atlas Roads Group (MQA).

Compounders: A company that is delivering an average market income, with sustainable above market income growth. For example, IPH Limited (IPH).

Cows: A company with a solid balance sheet and capital management potential (i.e. – higher payout, special dividends, buybacks. For example, Caltex Australia Limited (CTX).

Yielders: A company delivering above market income, however with minimal (or no) income growth. For example, Insurance Australia Group (IAG).

In the analysis following, we have created hypothetical portfolios (rebalanced annually) from the ASX100 (excluding mining and energy sectors) to include stocks based on the following criteria:

Growers: Gross dividend yield below the ASX200 Industrials Index with dividend yield growth above the ASX200 Industrials Index.

Compounders: Gross dividend yield within 1% of the ASX200 Industrials Index with dividend yield growth above the ASX200 Industrials Index.

Cows: Net Debt / EBITDA less than 1.5x and FCF yield above the ASX200 Industrials Index.

Yielders: Gross dividend yield above the ASX200 Industrials Index with no or declining dividend yield growth.

The chart below shows the relative performance of the portfolios (excluding franking) over the last 5 years, highlighting that a portfolio focused on yield alone would not have resulted in an optimal outcome for investors.

Conclusion

Now more than ever, income investors need exposure to a diversified portfolio of quality companies at reasonable prices, with good visibility on long-term dividend sustainability and after-tax benefits. A diversified equities strategy focused on sustainable and growing income generation, better protects retirees against downside risk, sequence risk and portfolio drawdowns and increases the compound total return over time, conserving capital and protecting against inflation.

About DNR Capital

Founded in 2001, DNR Capital is an Australian investment management company that delivers client-focused, quality, investment solutions to institutions, advisers and individual investors. DNR Capital is a signatory to the Principles for Responsible Investment (PRI).

DNR Capital’s leadership in the Separately Managed Account (SMA) sector was reaffirmed by being named SMA of the year at the Money Management Fund of the Year Awards 2017 for its Australian Equities High Conviction SMA.

For more information, please contact:

IMPORTANT NOTE: The information relating to DNR Capital has been prepared by DNR Capital Pty Ltd, AFS Representative – 294844 of DNR AFSL Pty Ltd ABN 39 118 946 400, AFSL 301658. Whilst DNR Capital has used its best endeavours to ensure the information within this document is accurate it cannot be relied upon in any way and you must make your own enquiries concerning the accuracy of the information within. The information in this document has been prepared for general purposes and does not take into account your particular investment objectives, financial situation or needs, nor does it constitute investment advice. Before making any financial investment decisions you should obtain legal and taxation advice appropriate to your particular needs. DNR Capital will not be responsible or liable to anyone who acts or relies upon anything contained in, or omitted from, this document. Past performance is not indicative of future performance.