The COVID-19 global pandemic has rapidly evolved into the unexpected and far-reaching shutdown of large parts of the global economy, sharply reducing short-term demand for goods and services, as well as disrupting manufacturing and supply chains.

Scott Kelly, portfolio manager at DNR Capital, a leading equities investment manager says: “Over half of ASX200 companies have downgraded or withdrawn future earnings guidance due to the lack of visibility in assessing the duration and severity of the COVID-19 pandemic.

“Company dividends are also likely to come under pressure as management teams and Boards respond to the disruption resulting from the COVID-19 outbreak.”

There are three key reasons for this, notes Mr Kelly.

1) Liquidity / balance sheet stress

Companies with high levels of operational gearing or high levels of debt could see a material impact on profitability and/or solvency as a result of business disruption. The ability to cancel or delay dividends may prove an important source of funding to preserve balance sheets and may also help avoid a dilutive equity raising.

To date, a minority of stocks have cancelled or delayed payment of previously announced dividends. However, given a shutdown could concentrate negative earnings in the June half, more companies may suspend the August/September dividend.

In our view, holding back dividends in the current environment is a prudent action for companies directly impacted by such unprecedented events.

2) Earnings downgrades

From the 20 February 2020 peak, the market has fallen ~27% and is already pricing in a global slowdown and cuts to forward Earnings Per Share (EPS) of ~5%. As COVID-19 cases keep rising, the market will price in even higher earnings cuts, possibly as much as ~30% (which is what occurred during the 2008 GFC).

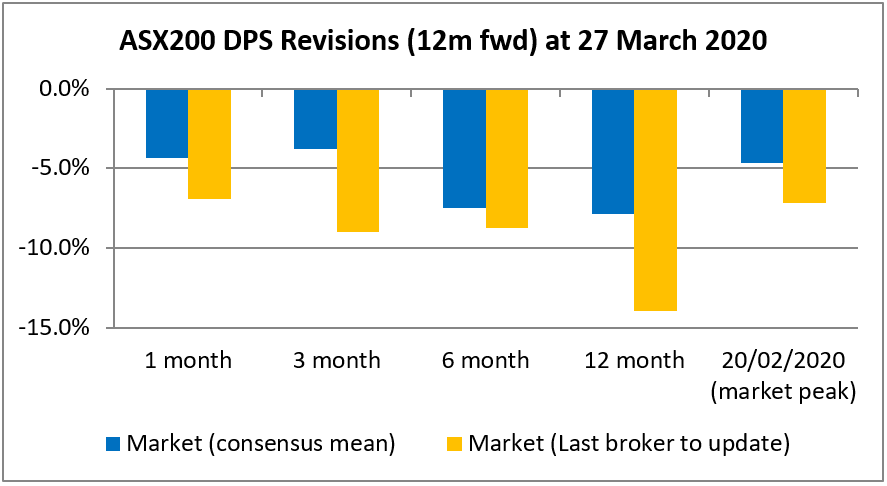

Dividends generally rise and fall in-line with EPS. To date, the market has only revised Dividends Per Share (DPS) down -5% (from the 20 February 2020 peak). As such, further DPS cuts are inevitable.

Source: DNR Capital, UBS, FactSet

Source: DNR Capital, UBS, FactSet3) Reduced payout ratios and conservatism

The current environment also gives Boards an opportunity to rebase dividend expectations to a level that creates less pressure in the future. This is what happened in the 2008 GFC, where payout ratios for Industrials fell from ~80% to ~70%.

Payout ratios have been rising since 2010, primarily driven by investor demand for dividends in a low interest rate environment. Whilst not at pre 2008 GFC highs, current payout ratios for Industrials are ~77%, so there is clearly downside risk.

Source: FactSet, Macquarie Research, March 2020

Source: FactSet, Macquarie Research, March 2020“However we expect company dividends to recover,” says Mr Kelly.

“Over the past few weeks we have focused on reviewing the investment cases for all our holdings. This includes revisiting dividend expectations and stress-testing all assumptions. We have been speaking directly with company management to understand how they are dealing with the impacts of disruption, reviewing balance sheets, and the likely impact on long-term cash flows, which underpin dividends.

“Whilst the DNR Capital Australian Equities Income Portfolio is not immune in the short term, we expect the impact on dollar income generated will be limited relative to its benchmark (the ASX200 Industrials Index) and should also recover within three years.

“The market is focused on the short-term impact of the COVID-19 disruption, however we believe there is more value in understanding the potential longer-term impact. In addition, as active portfolio managers, we are constantly seeking opportunities to enhance and supplement income for investors.

“We continue to position the portfolio in high-quality businesses that offer a combination of attractive dividend yields, growth, franking benefits and importantly, valuation support,” says Mr Kelly.

About DNR Capital

Founded in 2001, DNR Capital is an independent Australian investment management company that delivers client-focused, quality, investment solutions to institutions, advisers and individual investors. DNR Capital is a signatory to the Principles for Responsible Investment (PRI).

More: https://dnrcapital.com.au/

IMPORTANT NOTE: The information relating to DNR Capital has been prepared by DNR Capital Pty Ltd, AFS Representative – 294844 of DNR AFSL Pty Ltd ABN 39 118 946 400, AFSL 301658. Whilst DNR Capital has used its best endeavours to ensure the information within this document is accurate it cannot be relied upon in any way and you must make your own enquiries concerning the accuracy of the information within. The information in this document has been prepared for general purposes and does not take into account your particular investment objectives, financial situation or needs, nor does it constitute investment advice. Before making any financial investment decisions you should obtain legal and taxation advice appropriate to your particular needs. DNR Capital will not be responsible or liable to anyone who acts or relies upon anything contained in, or omitted from, this document. Past performance is not indicative of future performance.