DNR Capital, a leading Australian equities investment manager says retirees who stood to lose up to 30% of their income under Labor’s franking policy should revisit their investment strategies, particularly in light of historic low interest rates.

Labor’s failed franking policy is under review, with material changes likely (for example grandfathering provisions or cash refund caps), if it is not abandoned altogether.

“There was plenty of evidence that investors were reducing exposure to stocks with franking ahead of a potential change of government. In addition, it’s likely the uncertainty kept cash on the sidelines’’, says DNR Capital Australian Equities Income Portfolio Manager Scott Kelly.

This cash can now be invested with more confidence. However, we caution that business fundamentals should be the primary focus and investors should not base investment decisions solely on tax. Which is why we are underweight the Banks, and recently exited our positions in Telstra and Woolworths.’’

The banks

“The banking sector is more investable than it was. However, there are still a significant number of headwinds facing the sector including soft lending growth, intense competition, compressing margins and rising bad debts. The net outcome is the downside risk looks lower, but so does the upside risk. We remain underweight the sector and see other alternatives that provide leverage to an improving domestic economy.”

Telstra

“Despite the ACCC blocking the proposed TPG / Vodafone merger, it is not off the table, with TPG and Vodafone taking action in Federal Court later this year. Generally, mobile competition remains intense and has shown little sign of abating. In addition, there is still significant execution risk on Telstra’s product simplification strategy. The stock has been performing like a ‘yield stock’, however a net dividend yield of ~4% with no growth, is unattractive relative to other opportunities, in our view.”

Woolworths

“Woolworths has been a core portfolio holding, however we recently exited our position based on its full valuation. Woolworths remains a high quality business, however is facing industry headwinds from competition and changing shopper behavior. The stock price currently reflects an elevated FY20 PE multiple of ~24x and a yield of only ~3%, pricing in much of the upside and not much of the downside. We will closely monitor for opportunities to re-enter, should the valuation moderate.”

Alternative stock exposures

With franking policy certainty, retirees can more confidently consider Australian equity income strategies focused on growing income with after-tax benefits as an attractive alternative.

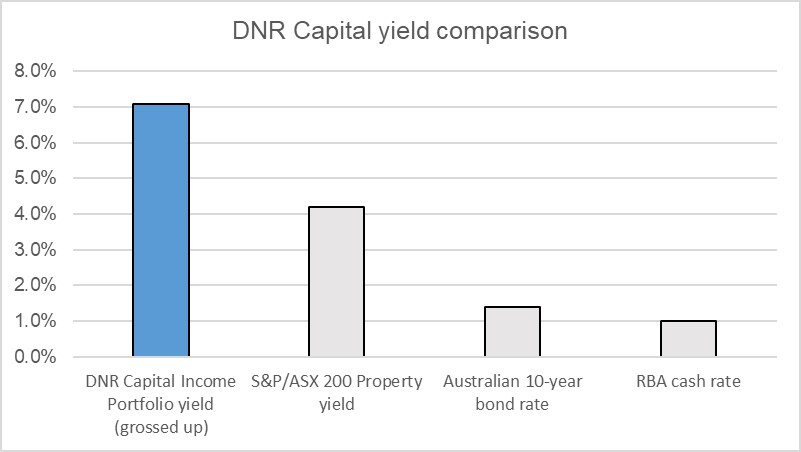

“Particularly given alternative investments are even less attractive, as bond-yields hit historic lows and with the RBA cutting rates to 1.0%.”

“The DNR Capital Australian Equities Income Portfolio holds a number of stocks that offer a combination of attractive dividend yields, growth, franking benefits and importantly, valuation support. These include: Tabcorp, Suncorp, Flight Centre, IPH and Super Retail.

The income portfolio is expected to generate a gross yield of 7.1% (including franking) for calendar year 2019, very attractive relative to alternatives,” Mr Kelly said.

About DNR Capital

Founded in 2001, DNR Capital is an independent Australian investment management company that delivers client-focused, quality, investment solutions to institutions, advisers and individual investors. DNR Capital is a signatory to the Principles for Responsible Investment (PRI).

More: https://dnrcapital.com.au/

IMPORTANT NOTE: The information relating to DNR Capital has been prepared by DNR Capital Pty Ltd, AFS Representative – 294844 of DNR AFSL Pty Ltd ABN 39 118 946 400, AFSL 301658. Whilst DNR Capital has used its best endeavours to ensure the information within this document is accurate it cannot be relied upon in any way and you must make your own enquiries concerning the accuracy of the information within. The information in this document has been prepared for general purposes and does not take into account your particular investment objectives, financial situation or needs, nor does it constitute investment advice. Before making any financial investment decisions you should obtain legal and taxation advice appropriate to your particular needs. DNR Capital will not be responsible or liable to anyone who acts or relies upon anything contained in, or omitted from, this document. Past performance is not indicative of future performance.